Asset Allocation Investing

Can you believe that super safe US Treasuries have out performed the S&P over the past 12 years? After a year of panic in the financial markets I decided that it is time for a back to basics investing approach so I can spend more time surfing and less time watching CNBC… We’ve now had more than a year of insanity in the financial markets. After losing substantial amounts in my retirement accounts and spending waaaay too much time reading and watching the financial news I decided that I needed a new investing approach. Some realizations include that bonds have outperformed stocks and that we’re not hearing about entire classes of assets from news sources like CNBC

While following the stock market’s ups and downs of the last year I caught a replay of David Swensen’s interview on NPR. David manages Yale’s endowment fund and has a very strong track record. He took time to write a book called “Unconventional Success: A Fundamental Approach to Personal Investment” (amazon.com) on personal investing and it seemed worth a read. I found the style a little dry but the content was really amazing. David advocates a back to basics approach of focusing on asset allocation and minimizing costs. “Asset allocation” consists of making sure that your assets keep the percentages in stocks, bonds, real estate, etc. that are in line with your goals. So if the S&P 500 index fund has a great 6 months you would sell some of it and buy some of the asset classes that aren’t doing as well to keep the proportion of money in each class consistent with your goals. The selling of over performing asset classes and buying of underperforming asset classes to keep your asset allocations consistent is called rebalancing. David suggests the following asset allocation percentages:

- Domestic Equity (30%)

- Foreign Developed Market Equity (15%)

- Emerging Market Equity (5%)

- Real Estate (20%)

- U.S. Treasury Bonds (15%)

- U.S. Treasury Inflation-Protected Securities (15%)

Right out of the gate I was intrigued as almost no other analysts recommend such a diverse set of assets including Real Estate (via REITs) and TIPS. David lays out in great detail why these asset classes are advantageous to individual investors and others like commercial bonds are generally not.

After reading David’s book I was struck by how much of the news and information I got was totally focused on US stocks even though the US equity market really hasn’t done that well over the past 10 years. Almost never do you see results for vanilla bonds or even REITs even though we hear lots and lots about the rest of the housing market. Yahoo! finance and Google finance don’t even include dividends in their historical return charts so every bond fund looks like it is performing poorly over time. I’d like to attribute these huge holes in the media to incompetence but I’m starting to suspect a bit of a conspiracy as US stocks are where the commercial mutual funds and brokerages make most of their money through management fees and commissions.

With my new skepticism after the last year of trauma in the financial markets I decided that I would do some empirical research on my own before starting David’s investment program. I looked historically at what would happen if you implemented this approach using Vanguard’s low cost index funds. Specifically I used the following funds:

- S&P 500 (VFINX)

- Developed Markets Index (VDIMX)

- Emerging Markets (VEIEX)

- Real Estate (VGSIX)

- Treasury Bonds (VFITX)

- TIPs (VIPSX)

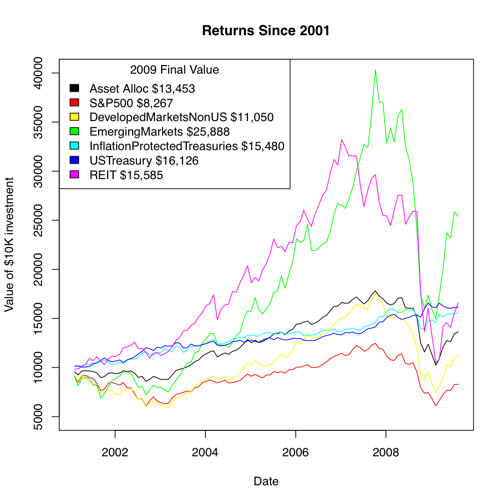

I downloaded the historic prices including splits and dividends for these funds from Yahoo! Finance and looked at the performance of these funds individually and using David’s rebalancing approach. The results from 2001 to August 2009 are shown in the plot below:

The first thing I noticed is just how poorly the S&P 500 and other domestic stocks performed over this time period. Plain old US Treasury bonds return almost double the S&P 500. REITs and Emerging Markets do quite well as well. The Asset Allocation algorithm does well overall although keeping 30% in domestic certainly weighs it down through the financial downturn of 2009. Let’s face it, bonds look really good on this chart but I do like the way that the asset allocation can take advantage of the booms without totally losing it on the busts.

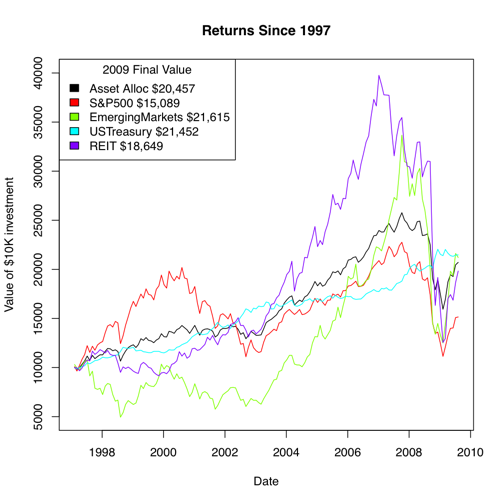

Dropping the TIPS fund an Developed markets fund which were started in 2000 we can look back to the inception of the other funds to 1997 with the following allocations

- Domestic Equity (VFINX 35%)

- Emerging Market Equity (VEIEX 10%)

- Real Estate (VGSIX 20%)

- U.S. Treasury Bonds (VFITX 35%)

Over the longer time frame we can see that the US Treasuries are still beating the S&P 500 substantially. We can also now see the impact of the late 1990s on the emerging market fund, making it look less appealing than the 2001 on time frame. The Asset Allocation approach does better over a longer period losing only to the US treasuries during years when the bubbles burst.

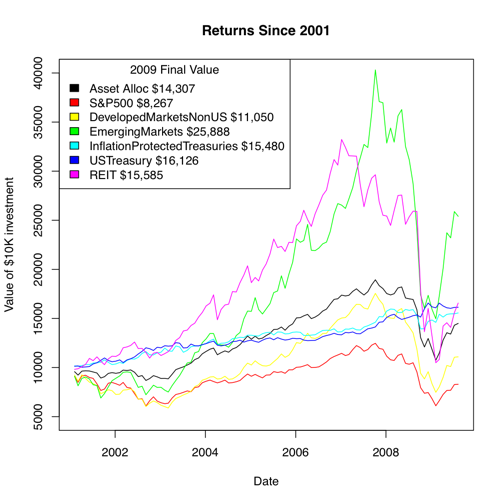

Going forward I anticipate that the US won’t be growing as fast as the rest of the world and I worry about the strength of the dollar with the size of the deficit going forward. Dropping the S&P 500 allocation and adjusting as follows I get the results below:

- S&P 500 (VFINX 25%)

- Developed Markets (VDMIX 15%)

- Emerging Markets (VEIEX 10%)

- Real Estate (VGSIX 20%)

- TIPS (VIPSX 15%)

- Treasuries (VFITX 15%)

I’m going to average into this allocation over the next few months. I’ll let you know how it goes. I’m hopeful both about the potential financial returns of this approach and emotional returns as I’m not worrying so much about investments.